Tally 110

Sale Bill Preparation

The said voucher is used to

“To prepare cash or credit sale invoice with in the state and out of state”

Ledger Accounts required for preparing a Sale Invoice:

(Follow Tally.102)

1 Cash-already available in the tally-under Cash in hand

2a- Party Ledger account (for state sale)-Under Sundry Debtors with state particulars.

2b- Party Ledger account (for Inter-state sale)-Under Sundry Debtors with outside state particulars.

3 Sale Local B2b-Under Sales Account

4 Sale Local B2c-Under Sales Account

5 Sale Interstate B2b-Under Sales Account

6 Sale Interstate B2c-Under Sales Account

7 Output CGST A\c-Under Duties & Taxes-Central Tax

8 Output SGST A\c-Under Duties & Taxes-State Tax

9 Output IGST A\c-Under Duties & Taxes-Integrated Tax

10 Round off A\c-Under Indirect Expenses

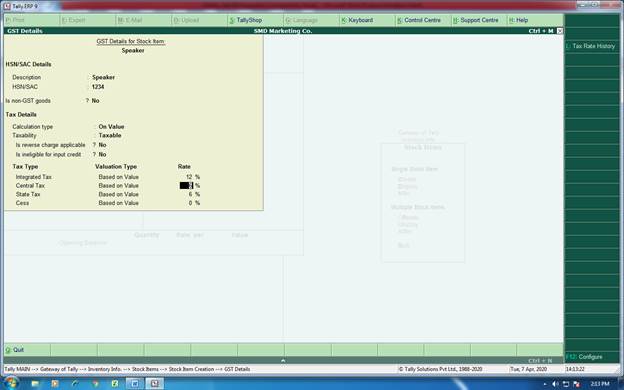

Stock Item to Open by Using Tally.103 & Tally.104 with GST rate

Gateway of tally (GOT)

↓

Press ‘F8’ Sale

↓

A For Cash State Sale

Party Name-Cash

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Output CGST A\C-(Calculate automatically)

Write Output SGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

B For Credit State Sale

Party Name-Name of the Party

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Output CGST A\C-(Calculate automatically)

Write Output SGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

C For Credit Inter-State Sale

Party Name-Name of the Party

Name of the Item-stock Item Name-write quantity & rate

Add more items if necessary

Press enter twice

Write Output IGST A\C-(Calculate automatically)

Write Round Off-(enter the value nearest to rupee)

(Such transactions shall automatically be possible by using “Sale Voucher type Creation)

Sale Bill Creation -Example

(Already created company named M/s SMD Marketing Co.)

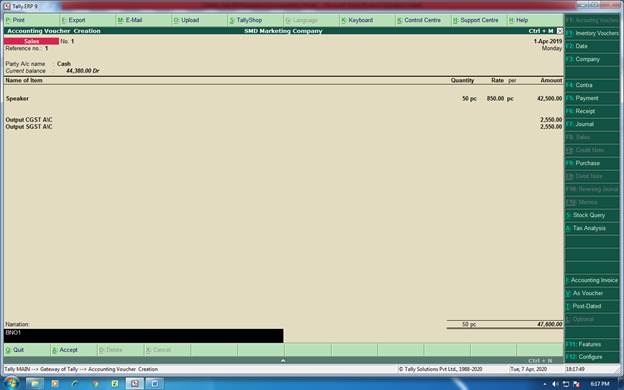

Problem 1-Within State Sales-Cash

Sold the following goods in cash:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Output CGST |

Output SGST |

Total |

|

Speaker |

50 |

850 |

42500 |

6% (2550/-) |

6% (2550/-) |

47600 |

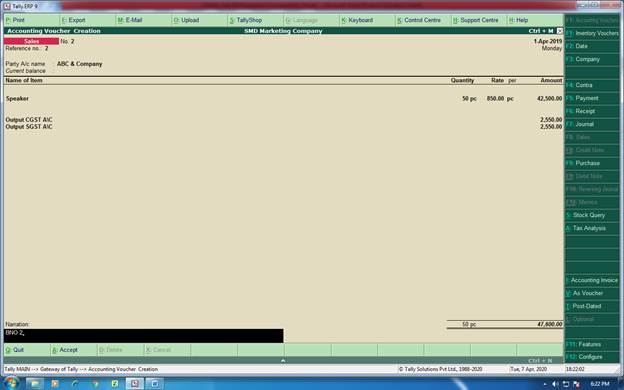

Problem 2-Within State Sales-Credit

Sold the following goods in to ABC & Company, Ludhiana, Punjab having GST number on credit:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Output CGST |

Output SGST |

Total |

|

Speaker |

50 |

850 |

42500 |

6% (2550/-) |

6% (2550/-) |

47600 |

Problem 3-Inter State Sales-Credit

Sold the following goods in to Sunder & Company, Delhi having GST number on credit:

|

Items |

Quantity (in Piece) |

Rate Per Piece (Rs.) |

Value |

Output IGST |

Total |

|

Speaker |

50 |

850 |

42500 |

12% (5100/-) |

47600 |

Solutions

(A) In the above problems following ledger accounts are required to create by using GOT-ALC:

LEDGER ACCOUNT-GOT-ALC-Sale Local B2b-Under Sales Account

Ledger Account-GOT-ALC-Sale Local B2c-Under Sales Account

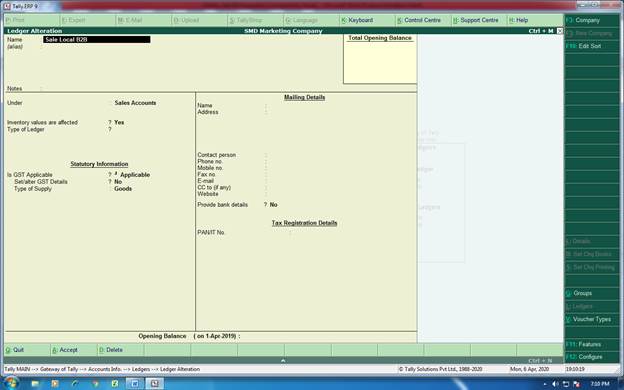

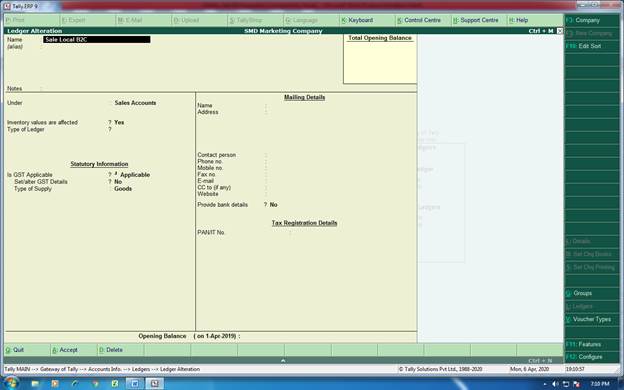

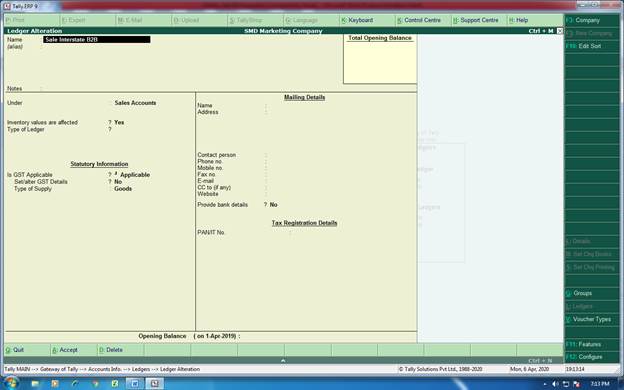

Ledger Account-GOT-ALC-Sale Interstate B2b-Under Sales Account

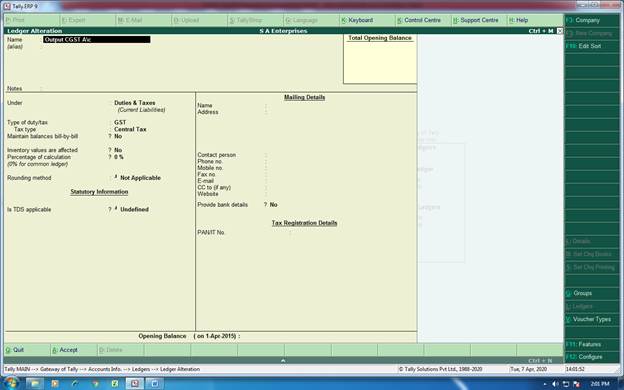

Ledger Account-GOT-ALC-Output CGST A\c-Under Duties & Taxes-Central Tax

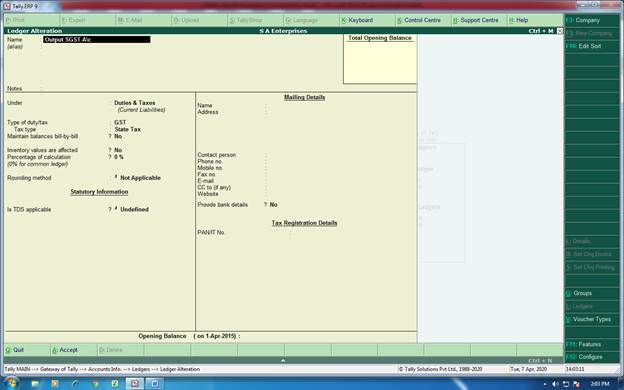

Ledger Account-GOT-ALC-Output SGST A\c-Under Duties & Taxes-State Tax

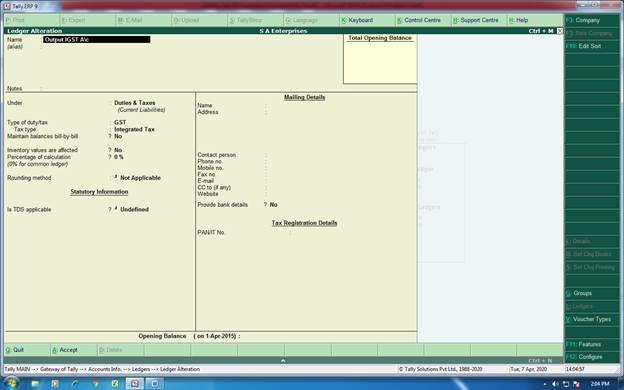

Ledger Account-GOT-ALC-Output IGST A\c-Under Duties & Taxes-Integrated Tax

Cash Account-already exists

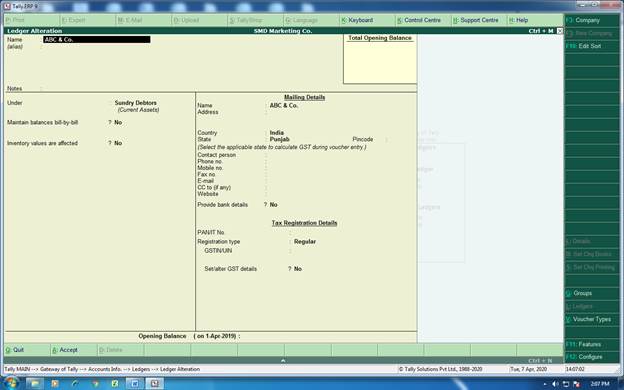

Ledger Account-GOT-ALC-ABC & Company Ludhiana with GST number and state Punjab under Sundry Debtors

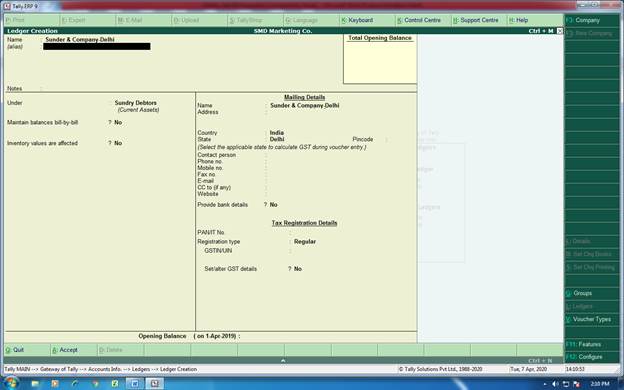

Ledger Account-GOT-ALC-Sunder & Company, Delhi with GST number and state Delhi under Sundry Debtors

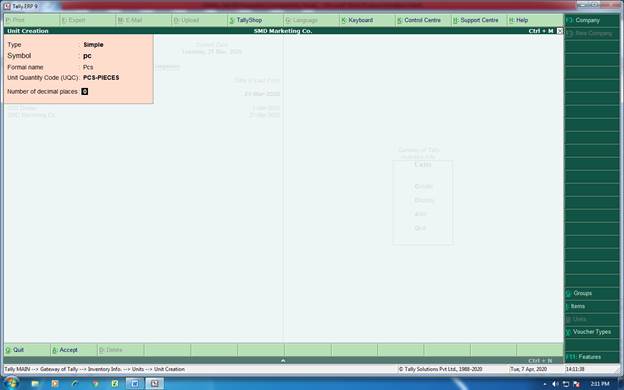

(B) Unit of measure ‘pc’ is required to create by using GOT-IUC

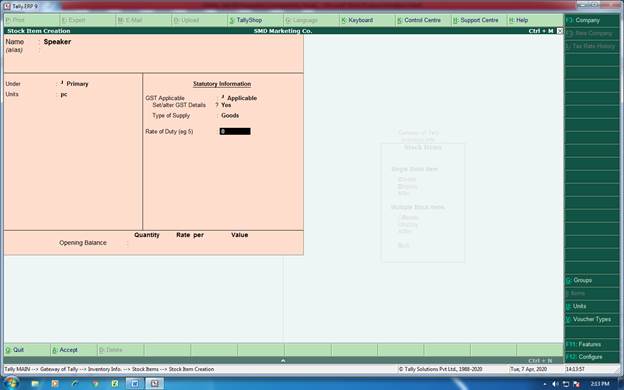

‘(C) Stock Item “Speaker” is required to create by using GOT-IIC

Problem 1

GOT-V-F8-SALES-View is as under:

Problem 2

GOT-V-F8-SALES-View is as under:

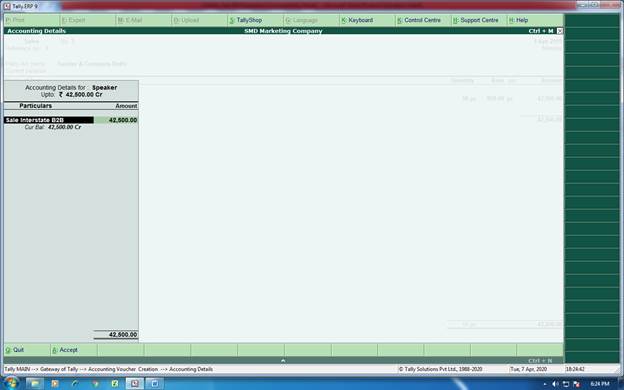

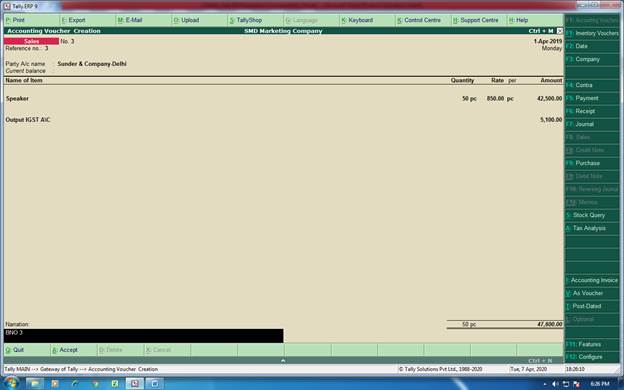

Problem 3

GOT-V-F8-SALES-View is as under:

This screen also appears for selection of sales